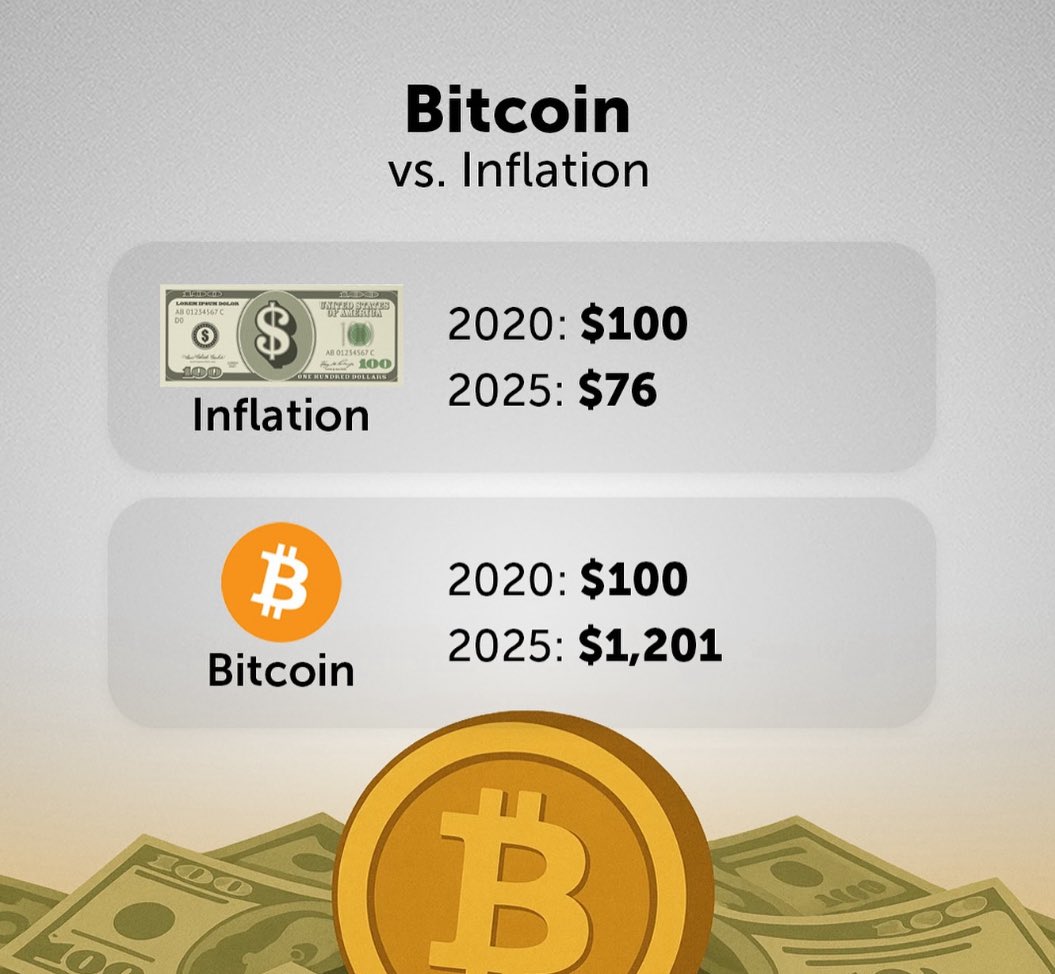

Bitcoin vs. Inflation: A Tale of Value Preservation

The image above starkly illustrates the impact of inflation on traditional fiat currency compared to Bitcoin’s performance. In 2020, $100 in U.S. dollars held its nominal value, but by 2025, inflation has eroded its purchasing power to just $76—a 24% loss. Meanwhile, the same $100 invested in Bitcoin in 2020 would be worth $1,201 by 2025, a staggering 1,101% increase. This comparison highlights a critical question: Is Bitcoin a better hedge against inflation than fiat currency?

The Erosion of Fiat Value

Inflation is a silent thief, gradually reducing the value of money over time. The U.S. dollar, like most fiat currencies, is subject to inflationary pressures driven by factors like government spending, money printing, and economic policies. Over five years, the dollar’s purchasing power dropped significantly, meaning your $100 buys less in 2025 than it did in 2020—think fewer groceries, smaller savings, or less fuel.

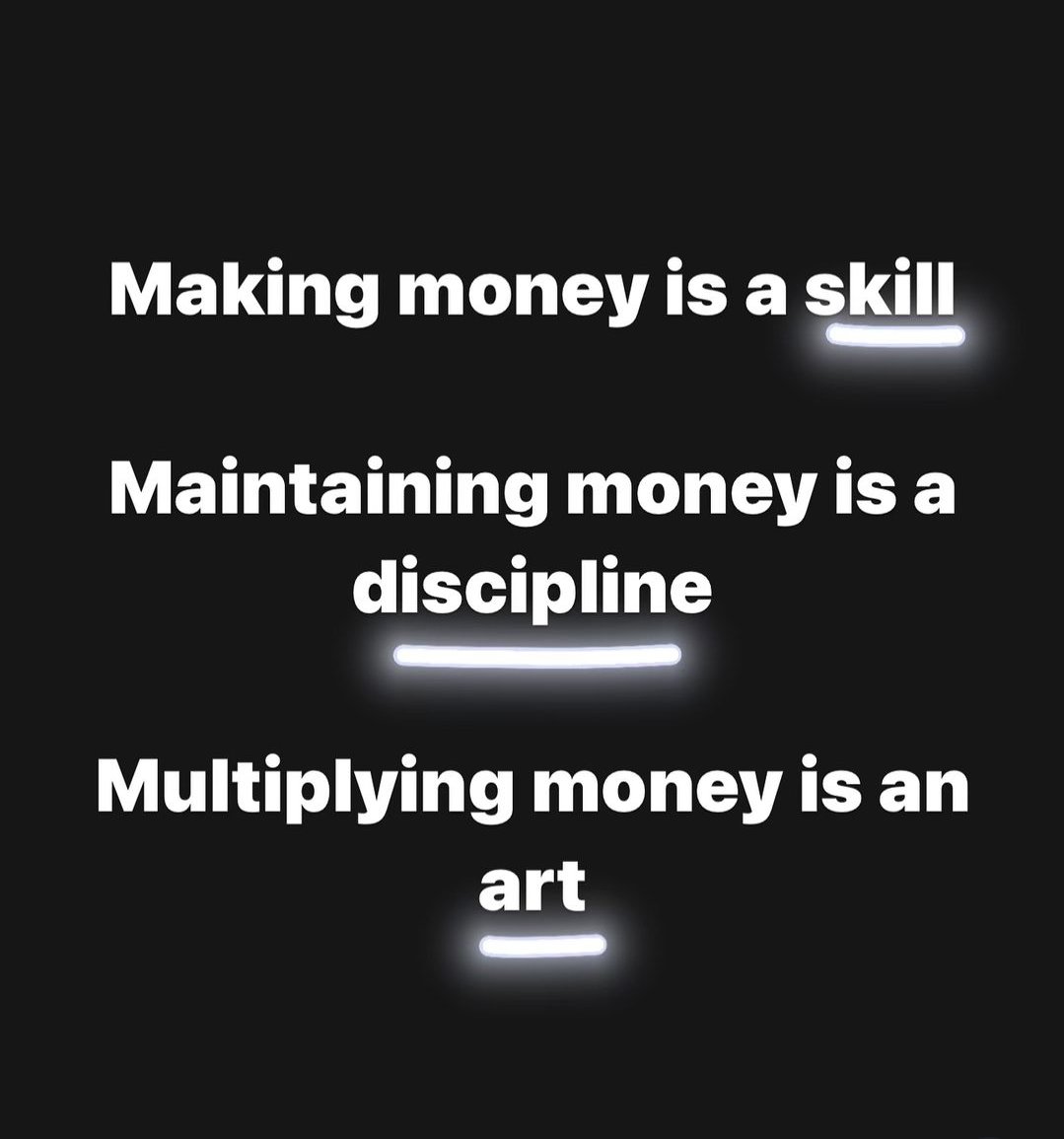

Bitcoin’s Meteoric Rise

Bitcoin, on the other hand, has shown remarkable growth. As a decentralized cryptocurrency with a fixed supply of 21 million coins, Bitcoin is designed to resist inflation. Its scarcity, coupled with growing adoption and demand, has driven its value upward. The $100-to-$1,201 jump reflects Bitcoin’s potential as a store of value, often dubbed “digital gold” by enthusiasts. Unlike fiat, which can be printed at will, Bitcoin’s supply is capped, making it immune to inflationary devaluation.

A Hedge Against Inflation?

This comparison suggests Bitcoin could be a powerful hedge against inflation. While fiat loses value, Bitcoin’s decentralized nature and limited supply have allowed it to not only preserve but multiply wealth. However, Bitcoin isn’t without risks—its price is volatile, and regulatory uncertainties loom. Still, for those wary of fiat’s steady decline, Bitcoin offers a compelling alternative.

Final Thoughts

The contrast between Bitcoin and inflation underscores a broader shift in how we think about money. As fiat currencies face devaluation, assets like Bitcoin challenge the status quo, offering a potential shield against inflation. While not a guaranteed bet, Bitcoin’s performance from 2020 to 2025 makes a strong case for its role in a diversified financial strategy. The question remains: Will you stick with fiat, or explore the world of digital currency?