From Silver to Paper: The Evolution of the U.S. Dollar Bill

The U.S. dollar bill, a staple in wallets worldwide, has a fascinating history that reflects shifts in economic policy—once a silver certificate, it’s now a Federal Reserve note. Understanding this transformation sheds light on how currency reflects a nation’s financial evolution.

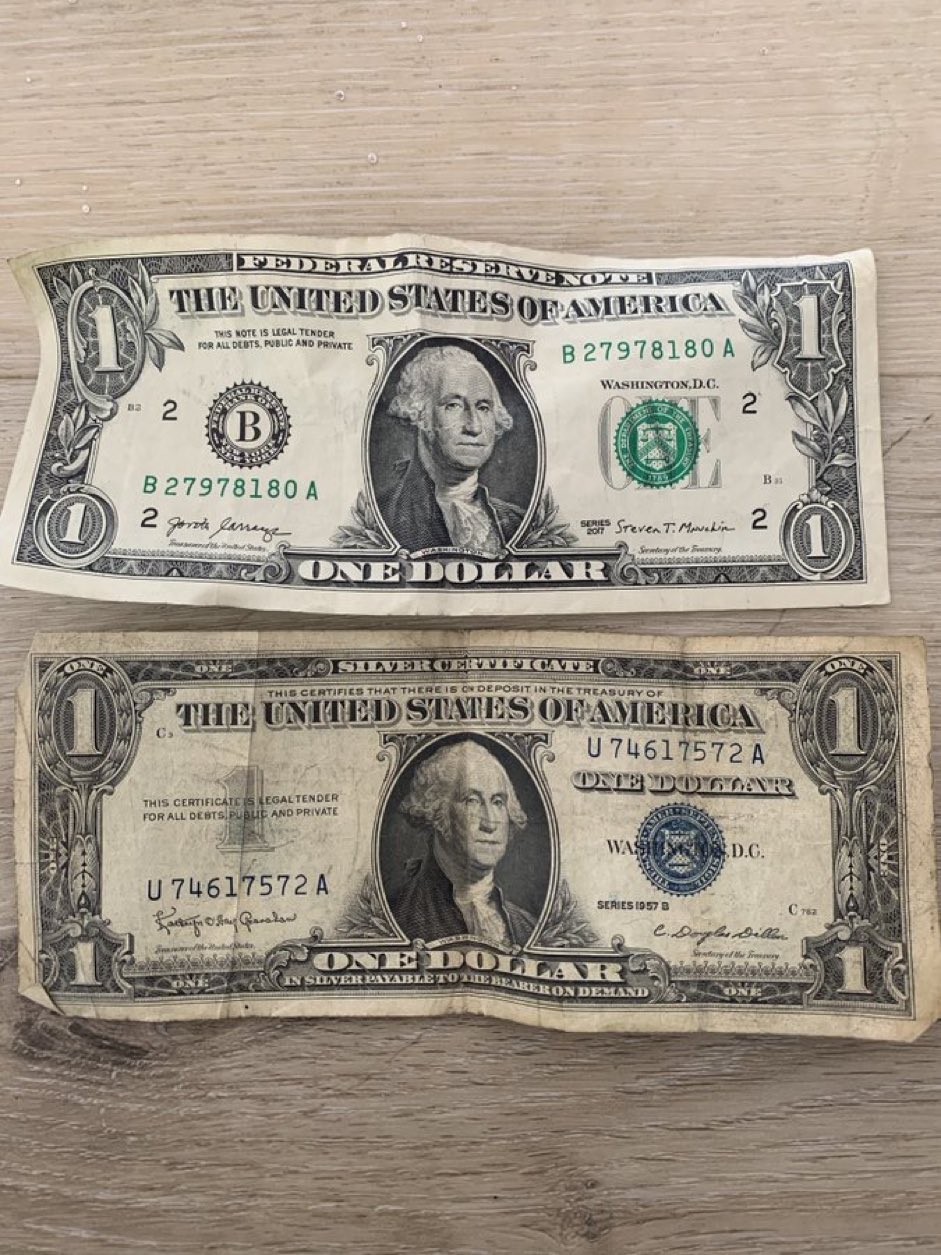

Silver certificates, first issued in 1878, allowed holders to redeem them for silver dollars or bullion, tying the paper’s value directly to precious metal; by 1933, a dollar bill literally stated it was “payable in silver on demand.” However, as the U.S. moved away from the gold and silver standards—fully abandoning silver redemption by 1968—these certificates were replaced by Federal Reserve notes, which are backed by the government’s credit and economic authority rather than physical metal, reflecting a shift to fiat currency.

Today’s Federal Reserve note, while still widely accepted, represents a promise of value rather than a tangible asset, a change that has fueled debates about inflation and currency stability. This evolution highlights the dynamic nature of money and invites us to consider what “real money” means in a modern economy.